Union Budget 2025 – Key GST & Tax Updates

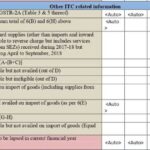

Introduction The Union Budget 2025, presented on 1st February 2025, introduces major changes in GST compliance, ITC claims, tax liability, and penalties. Here’s a complete analysis of the changes and their impact. Key GST Amendments in Budget 2025 1. Key Definition Changes Section Amendment Effective Date 2(61) ISD can distribute ITC on interstate supply, even …