Key Highlights of the Notification

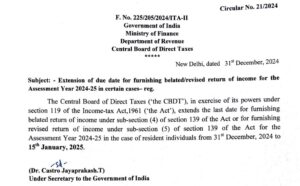

- Extended Deadline: Taxpayers now have an additional 15 days to file their belated returns under Section 139(4) or revised returns under Section 139(5) of the Income-tax Act, 1961.

- Applicability: The extension applies specifically to resident individuals filing for Assessment Year (AY) 2024-25.

- Legal Authority: The CBDT exercised its powers under Section 119 of the Income-tax Act to provide this extension.

Implications for Taxpayers

This extension offers the following benefits:

- Opportunity for Corrections: Individuals who missed the initial deadlines or need to correct errors in their original returns now have extra time to comply.

- Avoid Penalties: Filing within this extended window prevents penalties associated with non-compliance.

- Better Tax Planning: Taxpayers can align their filings more accurately with their financial records.

Hi, I’m Vishal

Founder of FinTaxExpert.in, with 7+ years of experience in taxation, audits, and corporate finance.

✍️ I’m passionate about writing and researching in the fields of taxation and finance.

📖 Learn more about us at FinTaxExpert.in.