September 4, 2025

The 56th GST Council meeting, chaired by Union Finance Minister Smt. Nirmala Sitharaman on September 3, 2025, has concluded, leaving a significant impact across various sectors of the Indian economy. The council announced a sweeping set of recommendations aimed at providing relief to consumers, rationalizing tax rates, and simplifying compliance for businesses.

From your daily groceries and household items to cars and electronics, these changes will affect the budgets of millions. For businesses, new trade facilitation measures promise to unlock cash flow and ease the registration process.

Let’s dive deep into the key takeaways and what these changes mean for you.

Key Highlights at a Glance

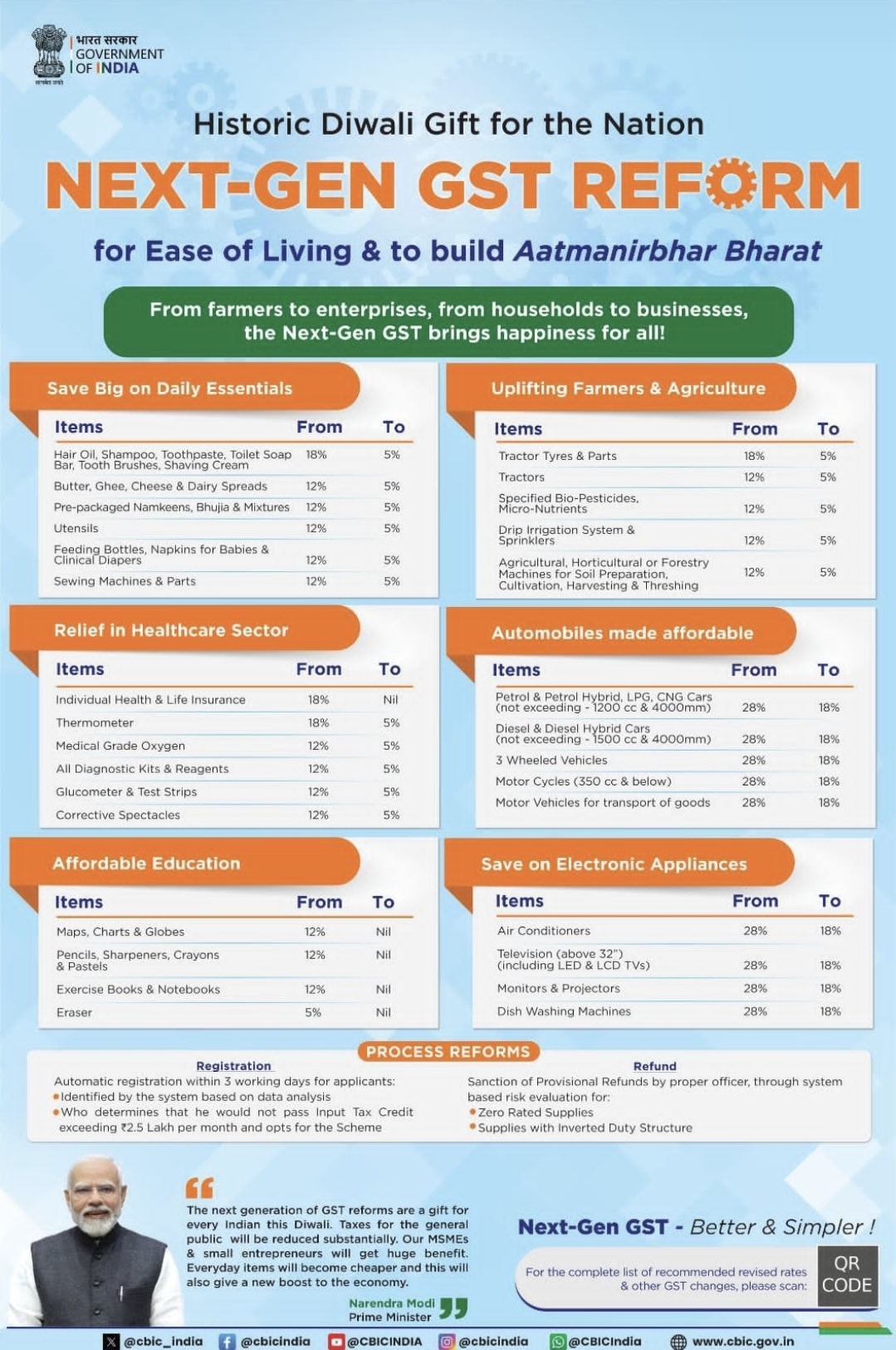

- Relief for the Common Person: GST rates have been slashed on numerous food products, common household goods, and educational items.

- Automobile Sector Revamp: A major restructuring of rates will make smaller cars and two-wheelers cheaper, while larger and luxury vehicles will become more expensive.

- Healthcare and Insurance Boost: Individual health and life insurance policies are now exempt from GST, and rates on many medicines and medical devices have been reduced.

- Trade Facilitation: Major procedural reforms, including a simplified registration scheme and faster, risk-based provisional refunds, have been introduced to help businesses.

- Rate Hikes on “Sin” and Luxury Goods: Taxes have been increased on items like pan masala, caffeinated beverages, and services like admission to casinos and race clubs.

A Major Win for Household Budgets

The council’s decisions bring widespread relief for the aspirational middle class and common households, with significant tax cuts on everyday items.

Food and Groceries

Your grocery bills are set to shrink. Here are some of the standout changes:

- Now Tax-Free (0%): UHT milk, pre-packaged paneer, pizza bread, khakhra, and roti. Even parathas, previously taxed at 18%, are now exempt.

- Down to 5%: The GST rate on a vast array of products has been cut from 12% and 18% to a uniform 5%. This includes:

- Dairy: Ghee, butter, condensed milk, and cheese.

- Processed Foods: Chocolates, cocoa powder, pasta, biscuits, cakes, pastries, corn flakes, and ice cream.

- Beverages: Fruit juices, tender coconut water, and plant-based milk drinks.

- Staples & Condiments: Sauces, jams, jellies, soups, and sugars.

Common Household and Personal Care Items

Daily essentials will also become more affordable:

- From 18% to 5%: Toilet soap, hair oil, shampoo, toothpaste, and talcum powder.

- From 12% to 5%: Safety matches, candles, umbrellas, bicycles, and kitchenware (iron, steel, copper, aluminum).

The Automobile and Electronics Shake-Up

Cars and Two-Wheelers: A Tale of Two Tiers

The auto sector sees a significant rate overhaul, creating clear winners and losers.

- Getting Cheaper (28% to 18%):

- Small petrol cars (engine capacity ≤ 1200cc, length ≤ 4000 mm).

- Small diesel cars (engine capacity ≤ 1500cc, length ≤ 4000 mm).

- Small hybrid vehicles meeting the above criteria.

- Motorcycles with engine capacity up to 350cc.

- Three-wheelers and goods transport vehicles.

- Getting More Expensive (28% to 40%):

- Larger cars and SUVs that exceed the small car specifications.

- Motorcycles with engine capacity over 350cc.

- Aircraft for personal use and yachts.

The council also provided relief to the agriculture sector by reducing GST on tractors and their parts from 12%/18% to 5%.

Consumer Electronics

Popular electronic goods will see a price drop as the GST rate is cut from 28% to 18% on:

- Television sets (including LCD and LED).

- Monitors and projectors.

- Air-conditioning machines.

- Household dishwashing machines.

Big Reliefs in Healthcare and Education

Health Sector

In a landmark move, the council has completely exempted individual health insurance and life insurance policies from GST. This is a massive relief that will make essential insurance coverage more accessible.

Other key changes include:

- Tax-Free Medicines (0%): Several high-cost drugs for treating rare diseases and cancer have been made exempt from GST.

- Rate Cut to 5%: GST on the majority of medicines, diagnostic kits, medical instruments, spectacles, and surgical gloves has been reduced from 12% to 5%.

Education Sector

Students will benefit from several items becoming tax-free:

- Exempt from GST (0%): Exercise books, notebooks, pencils, crayons, erasers, and pencil sharpeners.

- Reduced to 5%: Mathematical and geometry boxes.

Major Steps to Simplify Business and Trade

The GST Council has introduced several measures to improve the ease of doing business.

- Simplified Registration: A new optional, automated registration scheme will be launched. Low-risk applicants can get GST registration within three working days, a move expected to benefit 96% of new applicants.

- Faster Refunds: To improve cash flow for businesses, especially exporters, the council has approved a risk-based mechanism for sanctioning 90% of the claimed refund on a provisional basis. This applies to refunds from both zero-rated supplies (exports) and inverted duty structures.

- GST Appellate Tribunal (GSTAT) Operational Soon: The GSTAT will begin accepting appeals by the end of September 2025 and start hearings before the end of December. This will provide a much-needed, robust mechanism for resolving tax disputes.

- Boost for Service Exporters: The “place of supply” provision for intermediary services has been amended. This change will make the location of the service recipient the place of supply, allowing Indian exporters of such services to claim export benefits more easily.

Implementation Timeline

The new GST rates for both goods and services will be effective from September 22, 2025.

However, the rate changes for high-tax items like pan masala, gutkha, and cigarettes will be implemented from a later date, to be notified after the government’s compensation cess loan obligations are fulfilled.

The Bottom Line

The 56th GST Council meeting marks a pivotal moment in India’s tax reform journey. The decisions reflect a clear focus on providing targeted relief to households while rationalizing the tax structure for key industries like automotive, electronics, and textiles. The trade facilitation measures are a welcome step towards creating a more business-friendly environment.

As these changes roll out, businesses are advised to immediately review their pricing structures and ensure their accounting systems are updated to comply with the new rates. For consumers, the coming weeks should bring welcome price drops on a wide range of goods and services.

Hi, I’m Vishal

Founder of FinTaxExpert.in, with 7+ years of experience in taxation, audits, and corporate finance.

✍️ I’m passionate about writing and researching in the fields of taxation and finance.

📖 Learn more about us at FinTaxExpert.in.