1. Scenario Overview

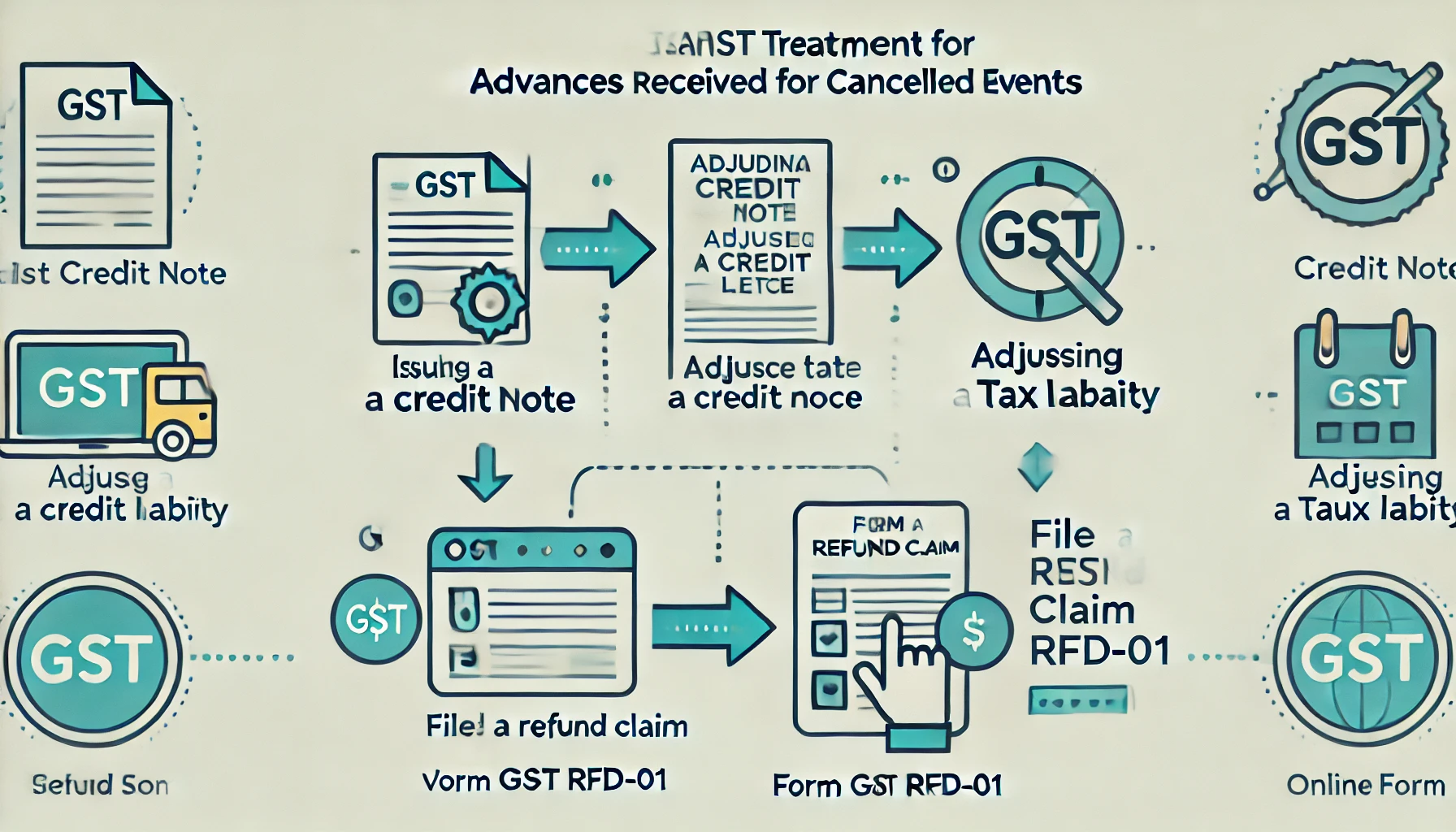

2. Issuance of a Credit Note under Section 34

When to Issue a Credit Note

Under Section 34 of the CGST Act, 2017, the supplier must issue a credit note to the recipient when:

- The supply of service is cancelled.

- The tax on the original invoice needs to be adjusted or reversed.

Details to Include in the Credit Note

- Original invoice reference

- Amount of advance and GST reversed

- Reason for issuance of the credit note

3. Declaring Credit Notes in GST Returns

Return for the Relevant Month

The supplier must report the details of the issued credit note in the GST return (Form GSTR-1) for the tax period in which the credit note was issued.

Impact on Tax Liability

If there is an existing output tax liability:

- The adjustment can be directly made in the return.

- The tax liability reduces by the GST amount mentioned in the credit note.

4. No Output Liability: Filing GST Refund Claim

In cases where there is no sufficient output tax liability to adjust the credit note, the supplier can claim a refund using Form GST RFD-01 under the category “Excess payment of tax.”

Steps to File Refund via GST RFD-01

- Log in to the GST Portal: Access the GST portal with your credentials.

- Navigate to Refund Section: Go to the “Refund” tab and select “Application for Refund.”

- Select Refund Type: Choose the refund type as “Excess Payment of Tax.”

- Provide Details: Enter details of the cancelled transaction and attach supporting documents (e.g., copies of credit notes, invoices, and proof of advance payment).

- Submit Application: File the form and track the status through the portal.

5. Key Points to Remember

- Timely Issuance of Credit Notes: Credit notes must be issued promptly to ensure proper compliance.

- No Separate Refund Required When Adjusted: If the credit note is adjusted in the return, there is no need for a separate refund claim.

- Maintain Documentation: Keep records of all invoices, credit notes, and communication with clients for audit purposes.

6. Legal Provisions: Section 34

Section 34 of the CGST Act governs the issuance of credit notes for scenarios like cancelled events. This provision ensures:

- Accurate alignment of tax liability with the actual supply.

- Legal backing for reversing GST already paid.

7. Example Scenario

| Date | Event | Details |

|---|---|---|

| March 2024 | Advance Received | ₹1,00,000 + 18% GST (₹18,000) |

| April 2024 | Event Cancelled | Credit note issued for ₹18,000 GST |

| April 2024 | Output Liability | ₹5,000 (Insufficient to adjust credit note) |

| May 2024 | Output Liability | ₹20,000 (Sufficient to adjust balance) |

8. FAQs

Q1. Can the credit note be issued for partial cancellation of services?

Yes, credit notes can be issued for partial cancellations, provided the corresponding GST amount is adjusted appropriately.

Q2. What happens if the supplier fails to issue a credit note?

Failure to issue a credit note can result in overpayment of GST and may lead to non-compliance issues.

Q3. Is the refund claim process under Form GST RFD-01 time-bound?

Yes, refund claims must be filed within two years from the relevant date, as per Section 54 of the CGST Act.

Hi, I’m Vishal

Founder of FinTaxExpert.in, with 7+ years of experience in taxation, audits, and corporate finance.

✍️ I’m passionate about writing and researching in the fields of taxation and finance.

📖 Learn more about us at FinTaxExpert.in.